- January 13th, 2025

5 Key Predictions for the Australian Property Market in 2025

The year ahead promises exciting opportunities for property investors—if you know where to look. Here’s what to expect and how to make the most of it.

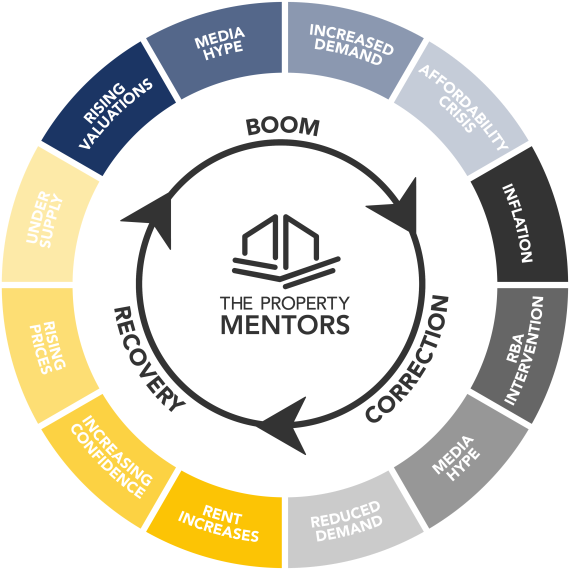

read moreWith the media honing in on interest rates (as opposed to property prices), it’s a good time to check in on the property clock and set your alarm!

Because at some point, inflation will correct, interest rates will stabilise, and buyer confidence will recover. Then – if Australia still has its ongoing issue with supply and demand when it comes to property – what do you think will happen to property prices? It’s only a matter of time…

In the meantime, as a serious property investor, what matters is how you navigate your way through this cycle, how closely you focus on your goals and how hard you stick to your long term plans. Because this is what will see you successfully through to a new day.

To put some context around today’s market, it’s useful to look at where we were sitting when Covid first struck (it’s not a pleasant trip down memory lane), as compared to where we were when restrictions ended...and what has happened in the following months.

MARCH 2020

Let’s set the scene, it’s March 2020. Covid has crept into Australia, the Grand Prix is about to be cancelled, panic buying will commence, the great toilet paper crisis is coming, state borders will close (not to mention international borders) and Melbourne is about to go into one of the world’s harshest lockdowns.

"Unprecedented times."

Unprecedented times indeed.

So let’s dig down into the statistics surrounding the economy in general (and property in particular) at the time...don’t neglect to look at the column for February 2022 and you’ll see where I’m headed with this).

MEDIAN AUSTRALIAN DWELLING $

March 2020: $554,229

February 2022: $728,034

TOTAL VALUE AUSTRALIAN RESIDENTIAL REAL ESTATE $

March 2020: $7.2 trillion

$9.8 trillion

OWNER OCCUPIER VARIABLE HOUSING INTEREST RATE FOR NEW LOANS, IN % PER ANNUM

March 2020: 3%

February 2022: 2.49%

March 2020: 0.25

February 2022: 0.10

March 2020: Over the 12 months to the March 2020 quarter CPI rose 2.2% before plunging by 1.9% in the quarter to June 2020, then surging upwards...

February 2022: Over the twelve months to the March 2022 quarter, the CPI rose 5.1%

I’m not going to dwell on what happened to property prices during this period. As a property investor, you already know. Every property owner in the country delighted in the fact that Australian home values rose by 24.6% (depending on who you ask) to record highs during this time frame. According to CoreLogic data, by February 2022 the total value of Australian residential real estate was sitting around $9.8 trillion, up from $7.2 trillion at the onset of the pandemic. Correspondingly, the median Australian dwelling value increased by $173,805, to $728,034.

What I want to bring to your attention instead, are interest rates.

Check out the interest rate back in March 2020 (according to the Reserve Bank of Australia (RBA) for lenders’ interest rates for owner occupier variable housing rates for new loans). We didn’t even hit the low point of 2.41 per cent until April 2022! But when we experienced our first rise for eleven years in May 2022 (to bring us up to 2.61 per cent) the media started to dig in seriously. And rates still haven't reached the point we were sitting at pre-Covid!

When the RBA raises the cash rate (the interest rate that a central bank – such as the RBA – charges commercial banks on unsecured overnight loans), this generally has a flow on effect, causing other interest rates in the economy to also rise. For example, your home loan. Likewise, if you have a savings account, the interest rate on your savings could increase (I say "could", as we all know the banks like to have their cake and eat it too).

The interest rates we have been enjoying were not your normal everyday "business as usual" interest rates. They were historically and abnormally low. In fact, you could even say, unprecedentedly low.

Because higher interest rates tend to reduce household spending, and this reduced demand tends to decrease the price of goods, thereby lowering inflation.

Which brings us to inflation (let’s not bring wages growth and the employment rate into this as well, please).

What has happened over the twelve months to the March 2022 quarter, is that CPI has risen by 5.1 per cent, with the most significant price rises being new dwelling purchases by owner-occupiers (up by 5.7 per cent) and automotive fuel (increasing by 11.0 per cent).

The RBA's inflation target is consumer price inflation of two to three per cent, on average, over time.

According to the Minutes of the Monetary Policy Meeting of the RBA released on 5 July 2022:

“Inflation is forecast to peak later in 2022 and then decline back towards the 2 to 3 per cent range in 2023. Higher interest rates will also help establish a more sustainable balance between the demand for and the supply of goods and services.”

Reserve Bank of Australia

The property clock should start to tick back into recovery mode in line with that forecast. That's not to say that interest rates will stay where they are, however there is light at the end of the tunnel.

In fact, we can already see an increase in rents, which will in turn help to drive investor confidence. That's you.

The CoreLogic Rent Value Index, which tracks changes in rental valuations over time, shows rents surging through 2021, rising 11.8 per cent and achieving new record highs.

“Since March 2020 house rental values have increased at nearly twice the rate of unit rental values with the gap blowing out to 13.5% in December 2021,” CoreLogic Research Analyst and report author Kaytlin Ezzy said.

She added, "It's likely the gap in rental values will narrow...as rental demand continues to shift towards relatively more affordable higher density properties."

CoreLogic’s Quarterly Rental Review for Q2 2022, released on 5 July 2022, shows the national rental index increasing 2.9 per cent over the June 2022 quarter.

"Rental demand across the medium and higher density segment has surged throughout the first half of 2022, partially driven by declining affordability in the house sector.”

Kaytlin Ezzy, CoreLogic Research Analyst

So here is where you check back in on the property clock, see where we’re at, where you think we’re heading, and either speak to your mentor about your property plans for the next 18 months, or book in a discovery call with one of our mentors and get started on your property journey today!

The year ahead promises exciting opportunities for property investors—if you know where to look. Here’s what to expect and how to make the most of it.

read more

Understanding the latest inflation figures and how they shape interest rate decisions—and property market opportunities.

read more

For the next 12 months, buyers in Victoria can save tens of thousands on stamp duty with a new government concession. Here’s how to take advantage of this incredible opportunity before it’s gone.

read more